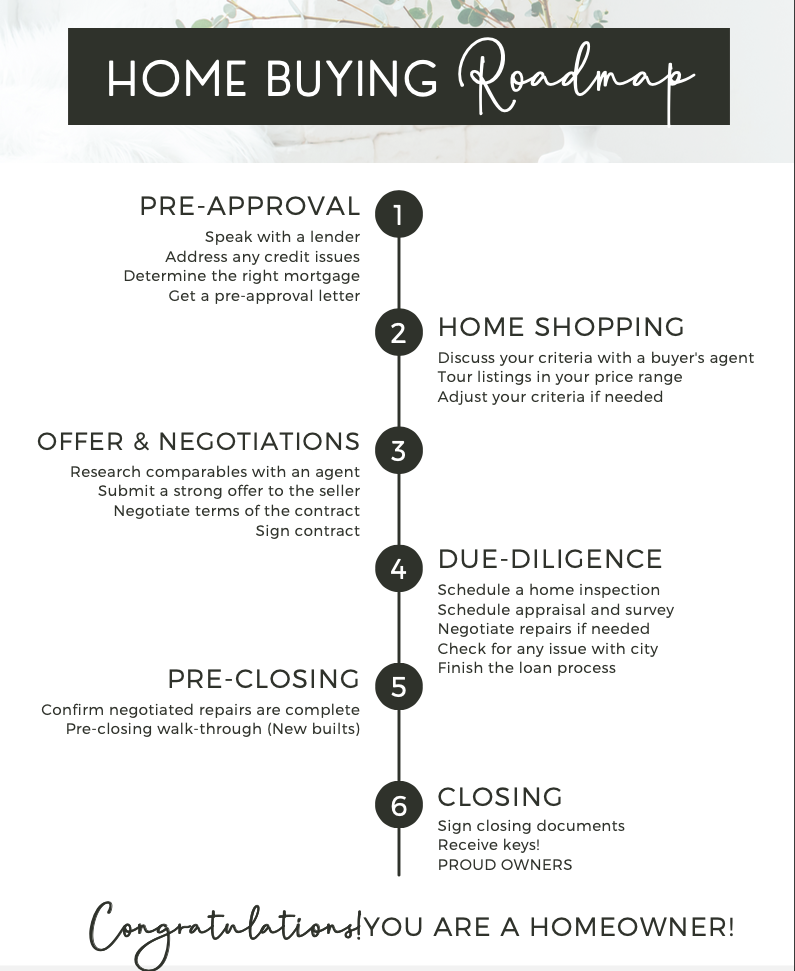

Buying a home can feel overwhelming, but breaking the process down into manageable steps makes it much easier. Our home buying roadmap guides you through every key milestone, from getting pre-approved for a mortgage to closing on your dream home. Follow these six simple steps to navigate the journey with confidence and make your homeownership goals a reality.

Step 1: Pre-Approval – The First Step to Homeownership

Before you start house hunting, it’s crucial to get pre-approved for a mortgage. This process sets you up for success and shows sellers that you’re a serious buyer. Here’s what you need to know:

Speak with a lender:

The first move is to connect with a trusted mortgage lender or broker. They’ll guide you through your financing options, explain the current market conditions, and help you understand what you can afford based on your income, debt, and other financial factors. Getting advice from a professional ensures you’re making informed decisions right from the start.

Address any credit issues:

Your credit score plays a big role in determining your mortgage eligibility and the interest rate you’ll be offered. If there are any issues on your credit report—like late payments or high debt—it’s a good idea to resolve them before applying for a loan. A better credit score could save you thousands in interest over the life of your mortgage.

Determine the right mortgage:

There are several mortgage options out there—fixed-rate, adjustable-rate, FHA, VA, and more. It’s important to choose the one that best fits your financial situation and long-term goals. Your lender can help break down the pros and cons of each option so you can decide which works best for you.

Get a pre-approval letter:

Once you’ve gone through the preliminary steps, your lender will issue a pre-approval letter. This letter shows sellers that your finances have been vetted and you’re approved to borrow up to a certain amount. It’s often required when making an offer on a home, so having it ready can give you a competitive edge.

Step 2: Home Shopping – Finding the Perfect Home

Once you’ve been pre-approved, it’s time for the exciting part—finding your future home. Here’s how to make the most of your home shopping experience:

Discuss your criteria with a buyer’s agent:

Start by meeting with a buyer’s agent who understands the local market. Share your must-haves, like the number of bedrooms, preferred neighborhoods, and any other features that are important to you. Your agent will use this information to narrow down listings and ensure you’re only viewing homes that meet your needs.

Tour listings in your price range:

With your agent’s guidance, start touring homes that fit your budget. Visiting properties in person (or virtually) helps you get a better feel for each home’s layout, condition, and surroundings. Take notes and compare your options carefully to find the right match.

Adjust your criteria if needed:

As you tour homes, you might realize that some of your initial preferences could shift. Maybe you’ll prioritize a bigger backyard over an extra bedroom or adjust your location to find a better deal. Stay flexible and work with your agent to refine your search as needed.

Step 3: Offer & Negotiations – Making Your Move

Once you’ve found the home you want, the next step is making an offer and negotiating the terms. Here’s how to navigate this crucial stage:

Research comparables with an agent:

Your buyer’s agent will help you research comparable homes (or “comps”) that have recently sold in the area. This research ensures that your offer is competitive while also reflecting the home’s market value, giving you a strong starting point.

Submit a strong offer to the seller:

With your comps in hand, work with your agent to craft a strong offer that shows the seller you’re serious. Along with the price, consider including a personal letter or favorable terms like a quick closing date to make your offer stand out. Your agent will handle the submission and communication with the seller’s side.

Negotiate terms of the contract:

The seller may accept your offer, counter it, or reject it. If they counter, you’ll enter negotiations. This is where you and the seller will finalize important details like the sale price, closing costs, contingencies, and any repairs or concessions. Your agent will guide you through this back-and-forth to secure the best possible deal.

Sign the contract:

Once you and the seller agree on the terms, it’s time to sign the contract. This legally binding document outlines everything that’s been agreed upon, so review it carefully with your agent. After signing, you’re officially on your way to becoming a homeowner!

Step 4: Due Diligence – Ensuring Everything Checks Out

Before finalizing the purchase, it’s crucial to complete the due diligence process. This step ensures there are no hidden surprises with the property and that everything is in order before closing.

Schedule a home inspection:

A home inspection is a must. It provides an in-depth review of the property’s condition, from the roof to the foundation. If the inspector finds any issues, you may want to negotiate repairs or request a credit from the seller to cover the costs.

Schedule appraisal and survey:

Your lender will require an appraisal to verify the home’s value. This ensures the loan amount is appropriate based on the property’s worth. Additionally, a property survey may be needed to confirm the exact boundaries and ensure there are no encroachments or disputes over the land.

Negotiate repairs if needed:

If the inspection reveals any major problems, you can negotiate with the seller to either make the repairs or lower the purchase price. This step ensures you’re not left with unexpected expenses after moving in.

Check for any issues with the city:

Make sure there are no outstanding permits, code violations, or liens on the property by checking with the city. This step ensures you won’t inherit any legal or financial issues related to the home.

Finish the loan process:

Once the appraisal is complete and all inspections have been addressed, work with your lender to finalize your mortgage. This includes providing any additional documentation they may need to complete the process.

Step 5: Pre-Closing – Final Checks Before the Big Day

As you approach closing, there are just a few more tasks to handle to ensure everything is in order before signing on the dotted line.

Confirm negotiated repairs are complete:

If you requested any repairs during the due diligence phase, now is the time to verify that they’ve been completed. Your agent can help coordinate this, and you may want to bring the inspector back for a follow-up to ensure the work was done properly.

Pre-closing walk-through (new builds):

For new constructions, it’s common to do a pre-closing walk-through with the builder. This is your chance to inspect the property and ensure everything is up to the agreed standards. Look for any unfinished work or defects and confirm that everything is in working order before you close the deal.

Step 6: Closing – Finalizing the Deal

You’ve made it to the final step! Closing is the official moment when ownership of the home transfers from the seller to you.

Sign closing documents:

At the closing meeting, you’ll sign a series of documents that finalize the purchase, including the loan agreement, deed, and title. Make sure to review everything carefully, and don’t hesitate to ask questions if something is unclear. Once all documents are signed, the deal is complete.

Receive keys:

After the paperwork is done, the moment you’ve been waiting for arrives—you’ll receive the keys to your new home! At this point, you officially become the proud owner of the property.

PROUD OWNERS:

Congratulations! All your hard work has paid off. Take a moment to enjoy this major achievement—you’re now a homeowner!